What Tax Form For Gambling Winnings . winnings from gambling, lotteries, and contests must be reported as other income on form 1040. Cash and the cash value of prizes are. whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. taxes on gambling winnings: file this form to report gambling winnings and any federal income tax withheld on those winnings. By the end of january, you may receive tax form. $600 or more on a horse race (if the win pays at. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to.

from www.templateroller.com

whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. file this form to report gambling winnings and any federal income tax withheld on those winnings. $600 or more on a horse race (if the win pays at. taxes on gambling winnings: By the end of january, you may receive tax form. Cash and the cash value of prizes are.

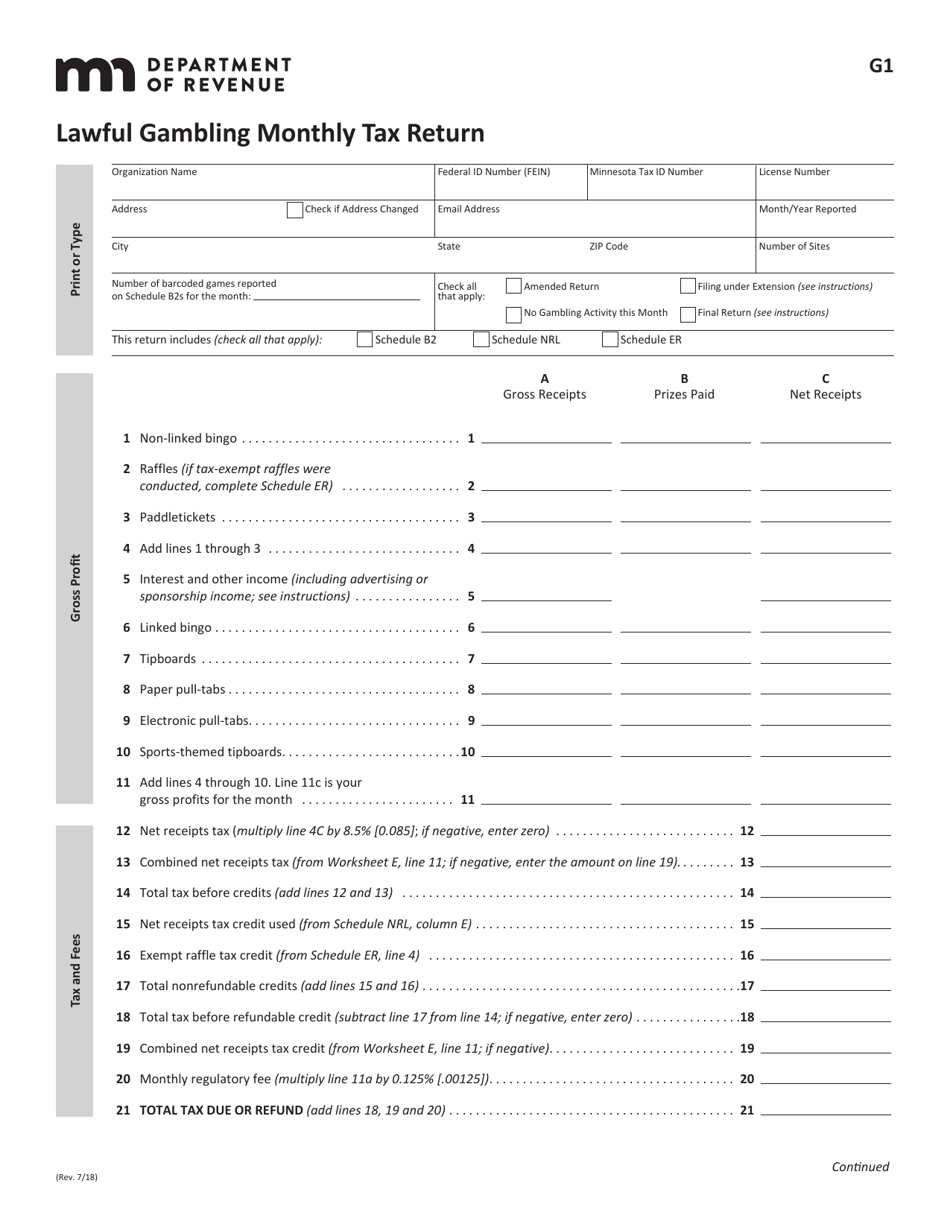

Form G1 Download Fillable PDF or Fill Online Lawful Gambling Monthly

What Tax Form For Gambling Winnings file this form to report gambling winnings and any federal income tax withheld on those winnings. Cash and the cash value of prizes are. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. By the end of january, you may receive tax form. taxes on gambling winnings: whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. file this form to report gambling winnings and any federal income tax withheld on those winnings. $600 or more on a horse race (if the win pays at.

From www.ah-studio.com

12 Form Gambling Winnings Learn All About 12 Form Gambling Winnings What Tax Form For Gambling Winnings By the end of january, you may receive tax form. file this form to report gambling winnings and any federal income tax withheld on those winnings. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. taxes on gambling winnings: whether you play the ponies or pull slots, your gambling winnings. What Tax Form For Gambling Winnings.

From www.formsbank.com

Gambling Tax Return Form printable pdf download What Tax Form For Gambling Winnings By the end of january, you may receive tax form. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. $600 or more on a horse race (if the win pays at. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. whether you play. What Tax Form For Gambling Winnings.

From www.templateroller.com

Form GMB5 Fill Out, Sign Online and Download Fillable PDF, New What Tax Form For Gambling Winnings By the end of january, you may receive tax form. file this form to report gambling winnings and any federal income tax withheld on those winnings. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. whether you play the ponies or pull slots, your gambling winnings are subject to. What Tax Form For Gambling Winnings.

From www.discounttaxforms.com

W2G Forms for Gambling Winnings, Winner Copy C2 DiscountTaxForms What Tax Form For Gambling Winnings taxes on gambling winnings: $600 or more on a horse race (if the win pays at. file this form to report gambling winnings and any federal income tax withheld on those winnings. whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. By the end of january, you may receive. What Tax Form For Gambling Winnings.

From www.pinterest.com

IRS Approved Blank W2G Gambling Winnings' Forms File this form to What Tax Form For Gambling Winnings By the end of january, you may receive tax form. Cash and the cash value of prizes are. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. $600 or more on a horse race (if. What Tax Form For Gambling Winnings.

From brownmar.weebly.com

Gambling Winnings Self Employment Tax brownmar What Tax Form For Gambling Winnings $600 or more on a horse race (if the win pays at. whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. Cash and the cash value of prizes are. gambling winnings are fully taxable. What Tax Form For Gambling Winnings.

From mapclever.weebly.com

Federal Tax Form Gambling Winnings mapclever What Tax Form For Gambling Winnings whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. taxes on gambling winnings: winnings from gambling, lotteries, and contests must be reported as other income on form 1040. Cash and the cash value of prizes are. By the end of january, you may receive tax form. gambling winnings. What Tax Form For Gambling Winnings.

From compassever.weebly.com

Where To Include Gambling Winnings On 1040 compassever What Tax Form For Gambling Winnings By the end of january, you may receive tax form. taxes on gambling winnings: file this form to report gambling winnings and any federal income tax withheld on those winnings. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. whether you play the ponies or pull slots, your. What Tax Form For Gambling Winnings.

From www.distudios.com

Tax On Gambling Winnings Australia What to read next What Tax Form For Gambling Winnings By the end of january, you may receive tax form. Cash and the cash value of prizes are. taxes on gambling winnings: whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. $600 or more. What Tax Form For Gambling Winnings.

From www.taxdefensenetwork.com

What Do I Do With IRS Form W2G? What Tax Form For Gambling Winnings taxes on gambling winnings: By the end of january, you may receive tax form. Cash and the cash value of prizes are. $600 or more on a horse race (if the win pays at. whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. winnings from gambling, lotteries, and contests. What Tax Form For Gambling Winnings.

From cardsrealm.com

Taxes in Casino are winnings taxable and losses taxdeductible? What Tax Form For Gambling Winnings taxes on gambling winnings: winnings from gambling, lotteries, and contests must be reported as other income on form 1040. Cash and the cash value of prizes are. By the end of january, you may receive tax form. $600 or more on a horse race (if the win pays at. whether you play the ponies or pull slots,. What Tax Form For Gambling Winnings.

From taxdataexchange.org

Excerpts from Publication 1220 What Tax Form For Gambling Winnings $600 or more on a horse race (if the win pays at. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. Cash and the cash value of prizes are. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. taxes on gambling winnings: By. What Tax Form For Gambling Winnings.

From www.formsbirds.com

Certain Gambling Winnings Free Download What Tax Form For Gambling Winnings whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. $600 or more on a horse race (if the win pays at. taxes on gambling winnings: gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. file this form to report gambling. What Tax Form For Gambling Winnings.

From www.youtube.com

Guide to IRS Form W2G Certain Gambling Winnings TurboTax Tax Tip What Tax Form For Gambling Winnings gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. By the end of january, you may receive tax form. taxes on gambling winnings: Cash and the cash value of prizes are. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. file this. What Tax Form For Gambling Winnings.

From gambleindiana.com

Tax Calculator Gambling Winnings Free To Use All States What Tax Form For Gambling Winnings whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. taxes on gambling winnings: $600 or more on a horse race (if the win pays at. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. Cash and the cash value of prizes. What Tax Form For Gambling Winnings.

From terweverco1977.mystrikingly.com

Casino Winning Tax Form What Tax Form For Gambling Winnings file this form to report gambling winnings and any federal income tax withheld on those winnings. Cash and the cash value of prizes are. winnings from gambling, lotteries, and contests must be reported as other income on form 1040. By the end of january, you may receive tax form. gambling winnings are fully taxable according to irs. What Tax Form For Gambling Winnings.

From www.formsbirds.com

Form 5754 Statement by Person(s) Receiving Gambling Winnings (2008 What Tax Form For Gambling Winnings By the end of january, you may receive tax form. file this form to report gambling winnings and any federal income tax withheld on those winnings. Cash and the cash value of prizes are. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. taxes on gambling winnings: $600 or. What Tax Form For Gambling Winnings.

From www.formsbank.com

Form Nj500M Return Of Gross Tax Withheld Form Salaries And Wages What Tax Form For Gambling Winnings winnings from gambling, lotteries, and contests must be reported as other income on form 1040. gambling winnings are fully taxable according to irs regulations but gambling losses can be deductible up to. $600 or more on a horse race (if the win pays at. By the end of january, you may receive tax form. file this form. What Tax Form For Gambling Winnings.